The Evolution and Future of Meta Platforms Inc. – A Statistical Deep Dive

Meta Platforms Inc., formerly known as Facebook, has grown rapidly from a college social network to one of the world‘s most valuable companies with over 3.5 billion monthly active users across its family of apps.

As Meta sets its sights on building the metaverse and dominating the next computing platform, let‘s take a data-driven look back at the company‘s meteoric rise as well as the opportunities and challenges ahead.

The Foundation: Facebook User Statistics

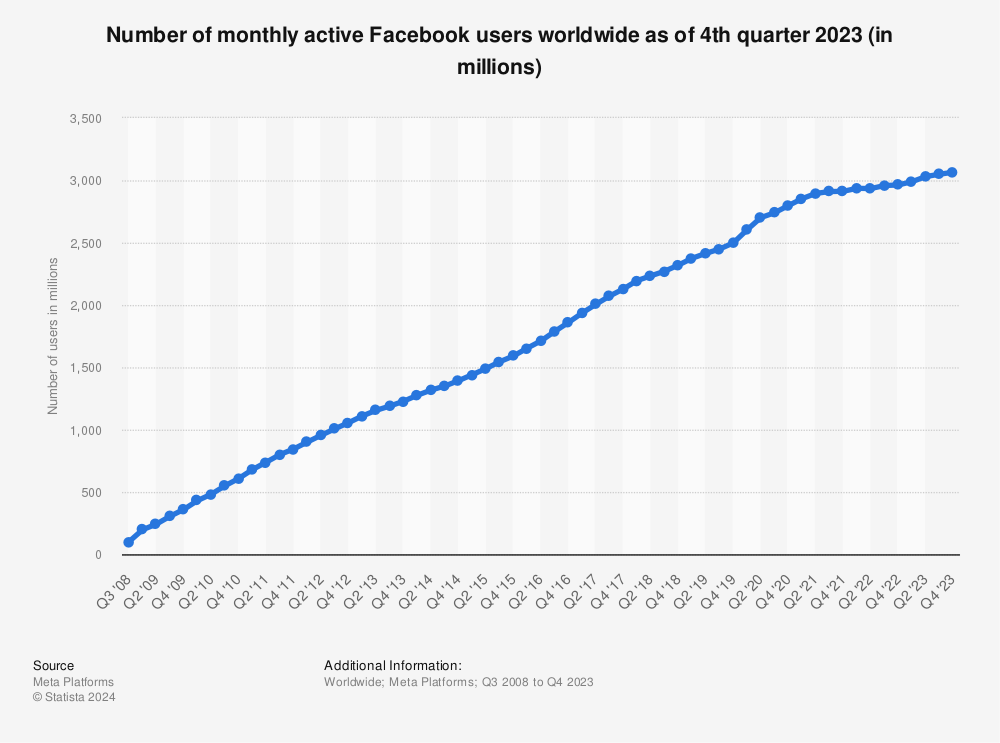

Facebook itself remains Meta‘s core app in terms of users, revenue and attention. As of Q4 2021, Facebook had 1.929 billion daily active users (DAUs) and 2.913 billion monthly active users (MAUs) worldwide.

North America accounted for 241 million DAUs while Europe followed closely with 234 million. Asia-Pacific led in terms of total user base with 1.085 billion MAUs.

Over 70% of Facebook monthly users accessed the platform via mobile devices as of Q3 2021.

While user growth in North America and Europe has tapered off, strong expansion is expected continue in developing regions like Asia-Pacific and Africa in the years ahead. Emarketer predicts Facebook‘s worldwide user base will hit 3.02 billion by 2025.

Diversifying the Portfolio: Instagram, WhatsApp and Messenger

Beyond its trademark blue app, Meta has aggressively expanded its portfolio of social media properties over the past decade with multibillion dollar acquisitions.

Instagram has been Meta‘s biggest mobile-centric hit. As of January 2022, the photo and video sharing network counted 1.478 billion daily actives and 2.028 billion monthly actives. Over 125 million Instagrammers hail from Europe while 444 million come from Asia-Pacific.

Crucially, Instagram has also succeeded as a hotspot for influencer marketing and commerce. Meta is investing heavily in shopping and other monetization features to turn the app‘s immense scale and engagement into ad revenue.

WhatsApp follows with nearly 2 billion MAUs worldwide as of February 2022. Although monetization has been slower, the messaging service remains indispensable in major markets like India and Brazil. Its strong encryption also provides a competitive edge.

Finally, Facebook‘s native Messenger app reaches over 1.3 billion people every month for texting, group chats, video calls and more. Deep integration across Meta‘s ecosystem gives Messenger unique network effects.

Combined with Facebook itself, Meta apps reach 3.59 billion unique users every month as of Q4 2021 – over 45% of the world‘s population!

Revenue and Profits: Meta‘s Money Machine

Meta‘s astounding user base translates into staggering profits thanks to its ad targeting and measurement capabilities.

For FY 2021, Meta Platforms reported total revenue of $117.9 billion. Operating income stood at $46.5 billion while net income exceeded $39.3 billion.

Advertising alone contributed $114.9 billion or 97.5% of total tops. Just five countries – US & Canada, Europe, Asia-Pacific, Rest of World and Other accounted for $115.2 billion i.e. 98% of global ad revenue.

Clearly, Meta enjoys unparalleled data access and network effects that enable precision ad targeting at immense scale. As consumers shift towards digital experiences, marketers have no choice but to spend big on Meta platforms to engage audiences.

Profit margins remain exceptionally high as well. For 2021, operating and net margins clocked in at a healthy 39.5% and 33.3% respectively.

As long as user growth continues in developing markets, Meta earnings could keep rising for years to come through further ad penetration.

Strategic Acquisitions: Instagram, WhatsApp and Beyond

Recognizing the shift to mobile early on, Meta has made several blockbuster acquisitions to amass different apps under its umbrella while taking out potential rivals.

The $1+ billion purchase of Instagram back in 2012 now looks incredibly far-sighted. Led by Kevin Systrom and Mike Krieger, Instagram went from 30 million to over 1 billion monthly users by 2018. Its aesthetic filters and short videos have become cultural staples for young generations.

Meta gained another strategic foothold in emerging markets by acquiring WhatsApp for $19 billion in 2014. Already dominant across Europe and Asia, WhatApp offered Meta big expansion opportunities in Latin America, Africa and India.

More recently, Meta has invested heavily in future platforms through acquisitions of Oculus VR ($2 billion) and a slew of AR developers. Future headsets and wearables could eventually replace smartphones as the primary compute/connectivity device for work, entertainment and social interaction in the metaverse.

All told, Meta has made over 80 acquisitions worth nearly $30 billion to date. And Zuckerberg & company show no signs of stopping as they continue hunting startups in VR, ecommerce and more.

Ownership and Control: Zuckerberg Calls the Shots

Who truly controls Meta Platforms Inc. given its financial and social influence? Look no further than founder & CEO Mark Zuckerberg who owns 13.2% of total shares along with majority voting rights.

As of December 2021, Zuckerberg‘s net worth stands at $125 billion with over 90% linked directly to his Meta stake. Of course, co-founder Eduardo Saverin owns around 4 million shares as well.

Other insiders like COO Sheryl Sandberg hold under 0.7 million shares each which is negligible percentage-wise.

Institutional investors make up the largest ownership bloc. Mutual fund giants like Vanguard Group (7.96%), Fidelity (4.75%) and BlackRock (2.24%) have invested tens of billions of dollars into Meta stock.

Over 2.3 billion FB shares also flow through exchange-traded and index funds passively tracking the Nasdaq and S&P 500.

Still, Zuckerberg maintains ironclad control over decision-making thanks to special Class B shares conferring majority voting power. This setup also insulates Meta from shareholder activism and takeover threats.

What‘s Next? Metaverse, VR and International Growth

While its family of social apps hum along smoothly, Meta has bigger ambitions for the long run. Namely, Zuckerberg wants to parlay the company‘s resources into dominating the successor to mobile – the metaverse.

By integrating VR/AR devices and environments, Metaverse aims to meld social connection, entertainment and shopping into immersive 3D experiences accessed through hardware like Ray-Ban Stories, Oculus Quest headsets and Project Cambria.

Virtual worlds could replicate everything from concerts and conferences to digital apparel and art. Even workplace collaboration and remote learning could move into Meta‘s Horizon Worlds infrastructure.

Analysts estimate the metaverse opportunity could reach up to $800 billion by 2024. Already, Meta is burning over $10 billion annually on metaverse R&D spanning hardware, software and content.

To support more natural interactions, Meta is building out a roster of lifelike avatars with legs, soft facial features and realistic eyes. Haptic gloves for touch input and feedback represent another key project.

If VR usage and e-commerce really prove the killer use cases, Meta will be incredibly well-positioned to capture profits while locking users into its interoperable ecosystem.

On the flip side, metaverse development carries substantial risk. Existing headsets remain too bulky and inconvenient for regular consumers. Myriad technical and physiological issues around vertigo or motion sickness need resolution.

Content and network effects will take years to foster organically. Hardware subsidies could torment earnings without a clear path to ROI. Regulatory troubles may emerge around data collection, privacy and identity verification.

Still, Zuckerberg seems convinced the next chapter for Meta lies in becoming an "embodied internet that you‘re inside of rather than just looking at." Only time will tell whether his ambitious leap into the unknown pays off.

Beyond futuristic metaverse plays, Meta also needs sustaining ad revenue growth from developing international markets like India, Brazil and Africa where internet and smartphone penetration remain relatively low.

As seen in the Facebook user statistics, North America and Europe have essentially peaked. Billions of potential customers are still coming online every year across LATAM, APAC and MEA. Rising incomes also allow greater digital ad spending over time.

With astute localization efforts, Meta can defend against upstarts like TikTok and capture the lion‘s share of new social media users – likely via Reels on Instagram. Proven acquisition engine WhatsApp also provides a flank for expansion.

Wrapping Up

Meta has clearly come a long way since Mark Zuckerberg‘s dorm room project in 2004. Flagship Facebook delivers enduring utility to billions while driving record profits through unparalleled targeted advertising.

Strategic buyouts like Instagram and WhatsApp serve as both defensive buffer and offensive springboard. Combined with indefinite profit reinvestment, Zuckerberg has accumulated tremendous resources to pursue ambitious moonshots.

The metaverse marks arguably Meta‘s boldest bet yet on transcending existing platforms. Of course, past performance is no guarantee of future success. Formidable challengers like TikTok and Apple also threaten to disrupt Meta‘s dominance in social sharing, messaging and mobile ads.

Still, given proven resilience and Zuckerberg‘s near-absolute authority, Meta remains a threat to upend computing paradigms for decades more. Regulators everywhere will be keeping a close watch.